Recession-Proof Your Portfolio with Marina Investments

With all the talk about recession coming, “Will it be a hard landing or a soft landing,” most financial analysts agree that we will move into a recession sometime in Q1 2024.

As a savvy investor, you may be reading this article because you realize your need to recession-proof your portfolio and are looking for alternative assets outside the stock market and traditional commercial real estate investments. An up-and-coming real estate opportunity is Marina Investments.

Marinas Thrive During Recessions

Up until the last couple of years, only a handful of investors have noticed that marinas outperform other real estate investment opportunities in IRR and their ability to thrive during recessions.

According to Neil Ross, the “father of the marina industry,” marinas have proven to weather past recessions better than any other investment and will remain solid investments for years to come. He says they tend to be the last sector to go into recession and the first to recover. (TRADE ONLY TODAY)

Beginning in 2020 during the COVID-19 recession, also known as the “Great Lockup,” boating increased as Americans sought healthy, outdoor experiences to enjoy with their families. According to the National Marine Manufacturers Association (NMMA), recreational boating saw a 36% increase in annual economic activity from 2018 to 2023.

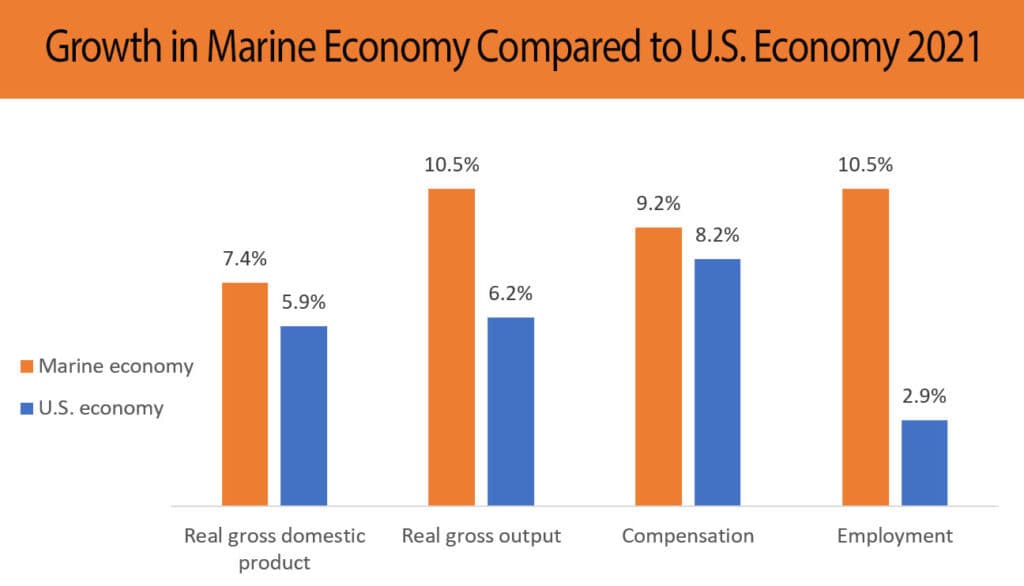

The Marine Economy Powered the US Economy During the 2020 Recession

Despite the global economic downturn of 2020, the marine industry contributed $361 billion to the nation’s gross domestic product, and its prosperity powered several main sectors of the economy. “Our oceans and Great Lakes are essential to America’s overall economy,” says NOAA Administrator Rick Spinrad, Ph.D. Economic data shows that marinas and their ancillary industries, such as boat sales, boat maintenance and repair, gas sales, construction, etc., all contribute to “buoying”

America’s economic well-being. National Oceanic and Atmospheric Administration

Top Reasons Marinas Are Recession-Proof

Long-term lease contracts with customers

Due to the significant demand for available boat slips, marina operators have leverage and can negotiate long-term lease contracts. These stable long-term revenue streams combined with significant upfront payments reduce the marina owner’s financial exposure during a recession.

Loyal customer base

Even marinas that have seasonal high and low periods of activity, such as peaks during the spring-summer period, benefit from stable yearly demand. This is due to the fact that the customer base is loyal, and ending their lease to dock at a competing marina is uncommon.

Marinas are a happy place for boat owners. Many of their best times occur at their marina. It is the same feeling a golfer has about his golf club membership. Why would you ever leave the marina where you meet up with your friends and create special memories?

High recurrent margins from a collective of businesses

The marina business is characterized by high profitability compared to other real estate investments due to the fact that it is a collective of businesses that provide year-round services. Depending on the marina strategy and offering, (its dock distribution, pricing, taxes, and additional value-added services, such as rentals, fuel, concierge services, etc.), Marina EBITDA margins range between 30%-50%.

Boating enjoys lasting appeal for Americans

In spite of stock market volatility and economic uncertainty, Axios reported in a September 2023 article that “Spending on pleasure boats continues to hover near remarkable highs.” This phenomenon is not a random occurrence; but recreational boating, which took off during the COVID-19 pandemic, continues to grow in popularity.

This growing American pastime is enjoyed by both rich and middle-income folks alike. According to the National Marine Manufacturers Association (NMMA), vast numbers of regular folks are fishing, water-skiing, sailing, and jet-skiing, and only one percent of this booming boat industry is from wealthy yacht owners. In 2020 and 2021, 800,000 first-time boat buyers entered the market (Marina Dock Age). Americans are prioritizing outdoor recreation, mental health, and unique experiences with close friends and family.

This continued interest in boating is excellent news for the marina industry. More boat sales increase demand for boat slips and the many year-round services the modern marinas offer. Below is data from the U.S. Bureau of Economic Analysis (chart courtesy of Axios) charting U.S. real personal spending on pleasure boats from August 2003 to July 2023.

Marina Trends and Forecasted Growth

When looking toward the future of the marina industry, the supply and demand metrics bode well for investors. With the increasing interest in boating, marinas will continue to be in demand, and those who turn mom-and-pop marinas into destination marinas will be rewarded handsomely.

Today’s boater wants marinas chock-a-block with amenities – restaurants, boutique hotels, and concierge services. With the tremendous potential for future redevelopment, this truly unique investment allows investors to acquire fee-simple, waterfront real estate in a destination where demand will continue to grow.

Recession-Proof Your Portfolio

If you agree with us that investing in marinas is the next best play as we enter the next recession, contact us to learn more. New Haven Marinas currently has an investment offering for verified accredited investors to potentially earn both current income and long-term capital gains. You can reach us by filling out our Contact Form.